Five Key Charts to Watch in Global Commodity Markets This Week

Global shipping rates are surging as tensions rise in the Red Sea, after the US and UK conducted airstrikes against the Iran-backed Houthi militants in retaliation for their attacks on merchant ships. Alcoa Corp. releases earnings on Wednesday, marking the unofficial start of the commodity world’s quarterly reporting season, while cocoa’s upward momentum continues.

![0kiqbsk]o4z3k0ff)jpix(j{_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2024/01/battery-prices-keep-getting-cheaper-lithium-ion-cell-and-pa.jpg?quality=90&strip=all&w=288&h=216&sig=j1AMun98AxNgGbpxS8f7Jw)

(Bloomberg) — Global shipping rates are surging as tensions rise in the Red Sea, after the US and UK conducted airstrikes against the Iran-backed Houthi militants in retaliation for their attacks on merchant ships. Alcoa Corp. releases earnings on Wednesday, marking the unofficial start of the commodity world’s quarterly reporting season, while cocoa’s upward momentum continues.

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Article content

Here are five notable charts to consider in global commodity markets as the week gets underway.

Article content

Shipping

Shipping companies are increasingly avoiding the Red Sea amid the escalating situation in the key global trade corridor. Before Friday’s allied strikes in Yemen, freight rates were already shooting higher amid a ramp up of attacks. The Drewry composite index — which is a weighted average for eight key routes — has surged 122% since Nov. 30 as ships are being forced to ply alternate waters and travel thousands of extra miles, resulting in fewer vessels to carry goods. The Houthis have vowed a response, which risks roiling global supply chains further and pushing freight costs up more.

Agriculture

A monster rally in cocoa isn’t letting up as the new year begins. Most-active futures in London closed out 2023 with the biggest annual advance in 15 years, while contracts in New York surged 61%. Both have edged higher in recent days on growing concerns over declining production. Traders will be focused on key grinding reports due Thursday for the final three months of last year in Asia, Europe and the US, seen as a proxy for demand. Weak processing data could dent prices, as it would signal softening consumption of discretionary items such as chocolate.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

Article content

Natural Gas

Liquefied natural gas shipments have skyrocketed since the opening of the first export facility in the Lower 48 states in 2016 as production has surged, with the US becoming the world’s biggest exporter last year for the first time. But the Biden administration — amid growing pressure from environmental groups and lawmakers to live up to its pledge to transition away from fossil fuels — is evaluating the climate criteria it uses to approve new export projects that could hinder the booming industry. There’s a “growing risk that the review will to lead to a formal or informal delay or pause in approvals,” Benjamin Salisbury, an analyst at Height Securities LLC, wrote in a note.

Earnings

Alcoa — the largest US producer of aluminum — is set to release fourth-quarter results on Wednesday after the close of trading. Shares tumbled 25% last year as the company struggled with operational and permitting setbacks in Australia for bauxite, and as global aluminum prices barely eked out a gain amid an oversupply. Alcoa last week said it was planning to halt output at one of its three Western Australian refineries as it begins to reckon with cost-cutting measures. Investors will be seeking guidance from Chief Executive Officer William Oplinger regarding any further operational adjustments, as well as possible impacts on market fundamentals from the continued buildup of Russian supplies at the London Metal Exchange.

Advertisement 4

Article content

Battery Metals

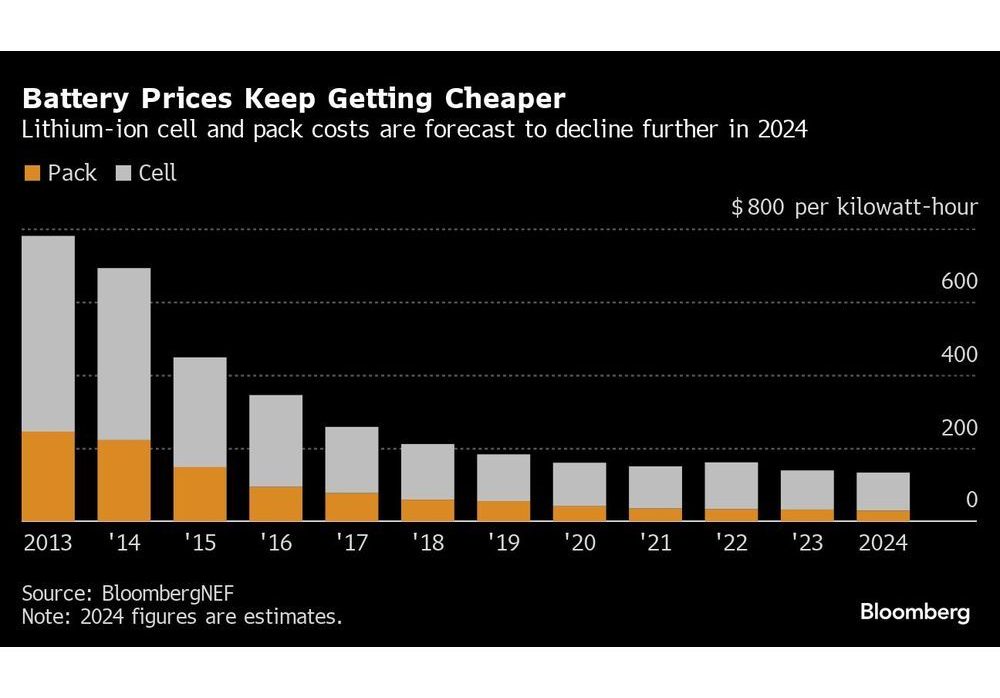

A tumble in raw materials like lithium, cobalt and nickel have led to a decline in battery costs that power electric vehicles. Last year, average prices fell to $139 per kilowatt-hour and are expected to drop a further $6 a kilowatt-hour in 2024, according to BloombergNEF. Despite the declines — a boon for consumers — there are growing concerns in the market. Overcapacity is leading to lower plant utilization rates, which in turn impacts margins for battery manufacturers, BNEF forecasts. Political, business and cultural leaders will convene starting Monday at the World Economic Forum in Davos, Switzerland, with critical minerals, EVs and the energy transition, among many other things, on the agenda.

—With assistance from Mumbi Gitau, Megan Durisin and Ruth Liao.

Article content